If they're frauding you on climate science, they're probably more than willing to

fraud you on all sorts of other important things:

The U.S. Securities and Exchange Commission is investigating how Exxon Mobil Corp. has valued its assets in the face of the current plunge in oil prices—and how it estimates theirfuture worth in a world of increasing climate change regulations, according to people familiar with the matter.

The SEC sought information and documents in August from Exxon as well as the company’s auditor, PricewaterhouseCoopers LLP. The federal agency has also been receiving documents that the company submitted as part of a continuing probe into similar issues begun last year by New York Attorney General Eric Schneiderman, the people said.

The formal investigation is examining Exxon’s longstanding practice of not writing down the value of its oil and gas reserves when prices fall. Exxon is the only major U.S. energy producer that hasn’t taken a write-down or impairment charge since oil prices plunged two years ago. Peers including Chevron Corp. have lowered valuations by a collective $50 billion.

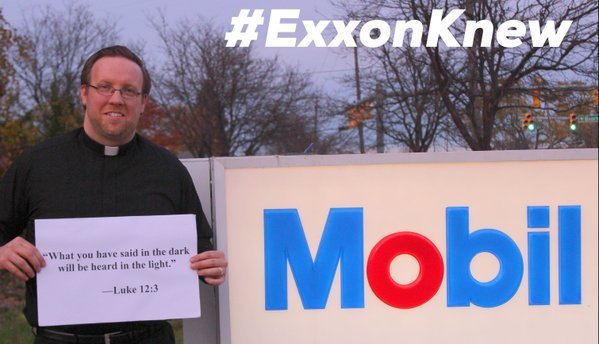

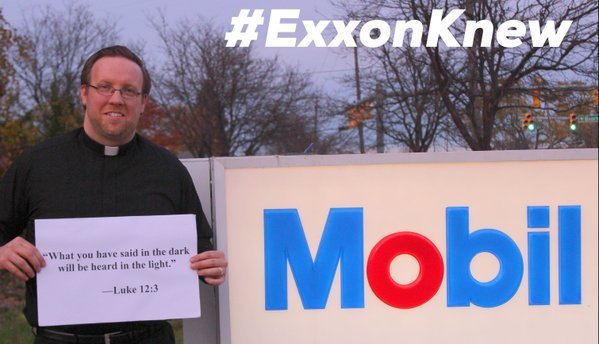

Learn more about Exxon's climate science fraud at

ExxonKnew.org.

If they're frauding you on climate science, they're probably more than willing to fraud you on all sorts of other important things:

If they're frauding you on climate science, they're probably more than willing to fraud you on all sorts of other important things:

No comments:

Post a Comment